Forex trading can be a lucrative venture, but it requires a solid understanding of strategies and market dynamics. This article will guide you through some of the most effective forex trading strategies to help you navigate the currency markets.

Understanding Forex Trading

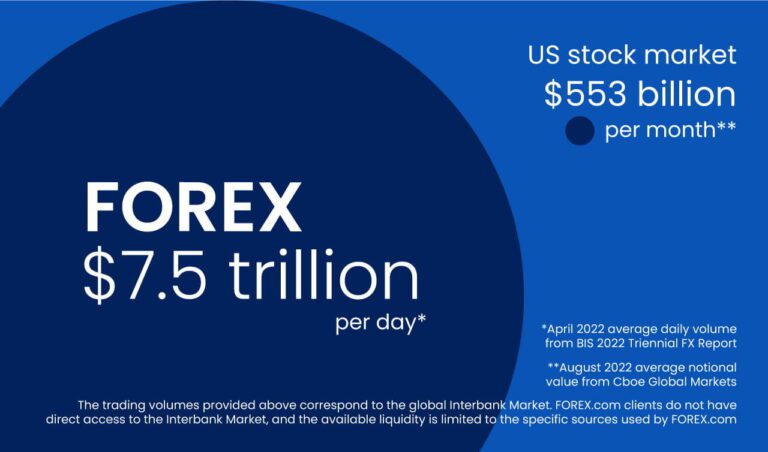

Forex (foreign exchange) trading involves buying and selling currencies to profit from fluctuations in exchange rates. The forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Understanding key concepts such as currency pairs, pips, and leverage is crucial for successful trading.

Key Concepts:

- Currency Pairs: Forex trading involves pairs, such as EUR/USD (Euro/US Dollar). The first currency is the base currency, and the second is the quote currency.

- Pips: A pip (percentage in point) is the smallest price move in a currency pair. For most pairs, a pip is usually 0.0001.

- Leverage: This allows traders to control larger positions with a smaller amount of capital, amplifying potential profits (and losses).

Popular Forex Trading Strategies

1. Scalping

Scalping is a short-term trading strategy focused on making small profits from numerous trades throughout the day. Traders who scalp typically hold positions for a few seconds to minutes.

Key Points:

- Requires quick decision-making and execution.

- Uses technical analysis and trading indicators.

- Focuses on high liquidity pairs.

Tools:

- Time Frames: 1-minute to 5-minute charts.

- Indicators: Moving averages, Bollinger Bands.

2. Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders capitalize on intraday price movements and do not hold positions overnight.

Key Points:

- Requires a strong grasp of market analysis.

- Emphasizes timing and risk management.

- Aims for larger profits than scalping but still within a single day.

Tools:

- Time Frames: 5-minute to 1-hour charts.

- Indicators: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence).

3. Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days to weeks to capture price swings. This approach is ideal for those who cannot monitor the markets continuously.

Key Points:

- Focuses on capturing larger price movements.

- Combines both technical and fundamental analysis.

- More relaxed than day trading and scalping.

Tools:

- Time Frames: 1-hour to daily charts.

- Indicators: Fibonacci retracement, Stochastic Oscillator.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for months or even years. This strategy relies heavily on fundamental analysis and is suitable for those who prefer a hands-off approach.

Key Points:

- Based on economic indicators and trends.

- Less affected by short-term market fluctuations.

- Suitable for investors with a longer time horizon.

Tools:

- Time Frames: Daily to weekly charts.

- Indicators: Economic news releases, trend analysis.

5. Carry Trade

A carry trade involves borrowing money in a currency with a low-interest rate and investing it in a currency with a higher interest rate. This strategy profits from the difference in interest rates, known as the “carry.”

Key Points:

- Exploits interest rate differentials.

- Can be risky due to currency fluctuations.

- Suitable for long-term traders.

Tools:

- Time Frames: Daily charts.

- Indicators: Interest rate announcements, economic reports.

Risk Management Strategies

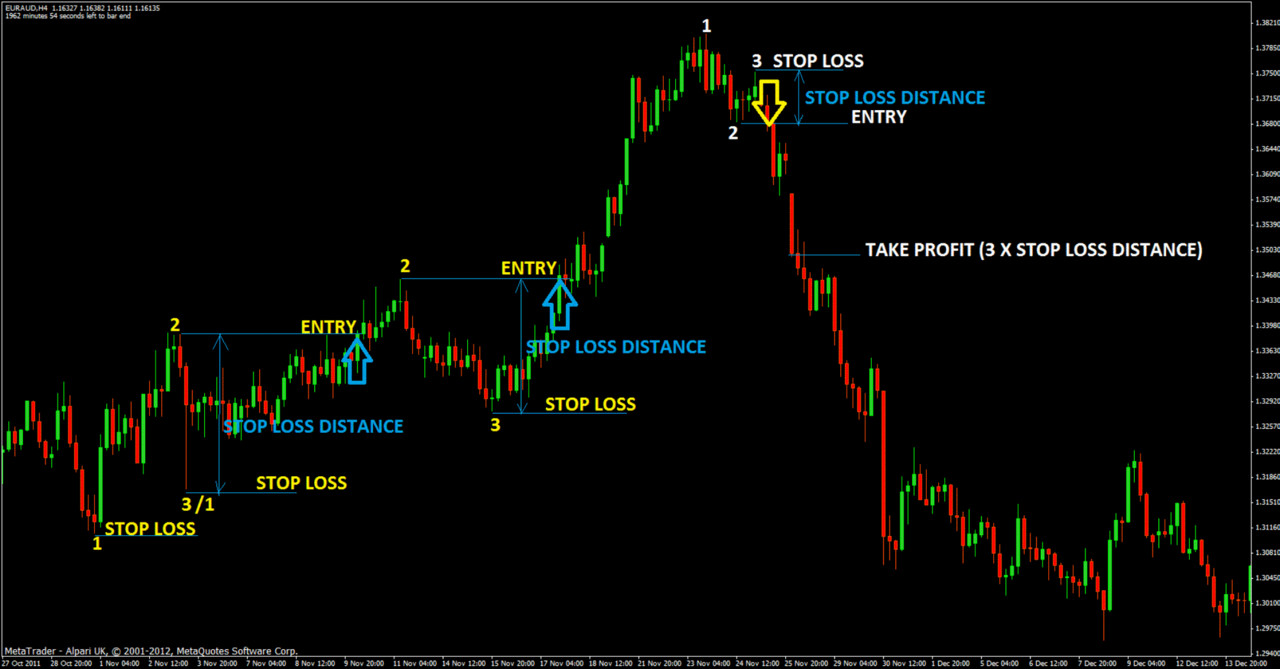

Regardless of the trading strategy you choose, effective risk management is essential. Here are some key techniques:

- Set Stop-Loss Orders: Always set stop-loss orders to limit potential losses.

- Use Take-Profit Orders: Lock in profits by setting take-profit levels.

- Risk Only What You Can Afford to Lose: Never risk more than a small percentage of your trading capital on a single trade (typically 1-2%).

- Diversify Your Portfolio: Avoid putting all your capital into one currency pair.

Conclusion

Developing a successful forex trading strategy requires knowledge, practice, and discipline. Whether you choose scalping, day trading, swing trading, position trading, or carry trades, ensure that you conduct thorough research and practice risk management. Start with a demo account to hone your skills before committing real money, and always stay informed about market developments.