Bybit is a cryptocurrency derivatives exchange known for offering futures trading with high leverage and advanced features for both beginners and professional traders. It’s popular for its user-friendly interface, robust security, and low latency trading infrastructure. Here’s an in-depth review of Bybit:

Key Features

- Futures and Perpetual Contracts:

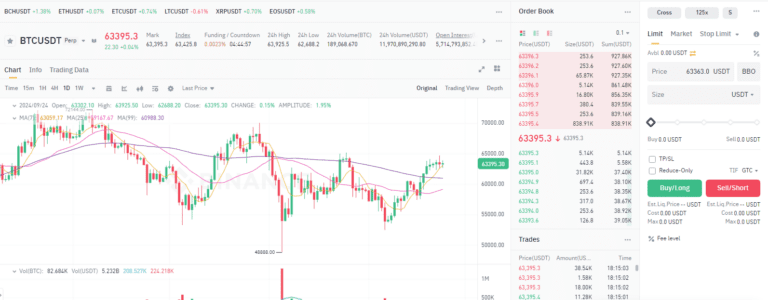

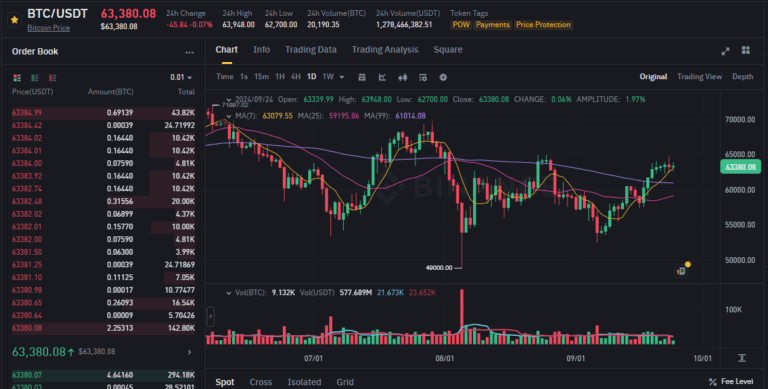

- Bybit focuses on perpetual contracts, where traders can speculate on the price of crypto assets without an expiration date. It also offers Inverse Contracts (settled in the cryptocurrency itself) and USDT perpetual contracts (settled in USDT).

- Leverage:

- Bybit allows high leverage trading, up to 100x on Bitcoin and other major cryptocurrencies like Ethereum. This leverage can amplify both profits and losses, making it suitable for experienced traders seeking to maximize gains in the short term.

- Low Latency and No Overload:

- One of Bybit’s selling points is its low latency, ensuring fast trade execution and avoiding system overload issues during periods of high volatility—a common problem on some other exchanges. It can handle 100,000 transactions per second (TPS), making it highly efficient.

- Insurance Fund:

- Bybit has an insurance fund to protect traders from negative balances. If a position gets liquidated, the insurance fund covers the losses, preventing traders from owing more than their deposit.

- Risk Management Tools:

- Bybit offers sophisticated risk management tools like:

- Take-profit and stop-loss orders.

- Cross-margin and isolated margin modes, allowing traders to manage the risk of each position individually or across all open trades.

- Price Protection: Prevents unfair liquidations during volatile market conditions.

- Bybit offers sophisticated risk management tools like:

- Testnet for Demo Trading:

- Bybit provides a testnet platform where users can practice trading with simulated funds, making it ideal for beginners who want to learn without risking real money.

User Interface and Experience

- Clean and User-Friendly Interface:

- Bybit has a well-designed and intuitive interface, making it accessible even for beginners. The dashboard displays all necessary information such as order books, charts, and positions clearly.

- Advanced Charting:

- Integrated with TradingView, Bybit’s charting tools are very advanced, allowing traders to conduct technical analysis with ease. You can customize your charts and use technical indicators to spot trends and price movements.

- Mobile App:

- Bybit offers a mobile app for both iOS and Android, which is well-optimized, offering nearly all the same functionalities as the desktop version. Traders can execute trades, monitor markets, and manage their positions on the go.

Fees and Funding Rates

- Competitive Trading Fees:

- Maker Fee: 0.01%

- Taker Fee: 0.06%

- The maker/taker fee structure is competitive, especially for active traders who provide liquidity (maker orders).

- Funding Rates:

- Similar to other derivatives exchanges, Bybit charges a funding rate for perpetual contracts. This rate is paid between long and short positions every 8 hours, depending on market conditions. It helps ensure that the contract price stays in line with the spot market.

Security

- Cold Wallet System:

- Bybit uses a cold wallet system, meaning that 100% of funds are stored offline, significantly reducing the risk of hacks. Withdrawals are processed manually three times a day to further protect users’ funds.

- Two-Factor Authentication (2FA):

- The platform supports 2FA for account security, protecting users from unauthorized access.

- Proof of Reserves:

- Bybit is transparent with its reserves and periodically conducts proof of reserves to assure users that it holds the assets backing customer deposits.

Customer Support

- 24/7 Customer Support:

- Bybit has a strong reputation for offering responsive and helpful customer support via live chat, email, and social media. The exchange also has a comprehensive Help Center with tutorials and guides for troubleshooting.

Advantages of Bybit

- High Leverage: Traders looking for significant exposure can access up to 100x leverage.

- Risk Management Tools: Advanced tools for limiting risks, including stop-loss and take-profit orders.

- Great Liquidity: Bybit has deep liquidity, making it ideal for high-volume traders and institutional traders.

- Fast Execution: With no system overload issues, Bybit provides efficient and quick order execution.

- Insurance Fund: Helps protect traders from extreme losses beyond their margin.

Drawbacks of Bybit

- No Spot Trading (until recently): Bybit was primarily a derivatives exchange and only introduced spot trading in 2021, so its spot trading features may be less developed compared to established spot trading platforms like Binance.

- No Fiat Deposits: Bybit does not allow direct deposits of fiat currencies like USD or EUR. Users need to deposit cryptocurrency or use third-party services to convert fiat to crypto.

- High Risk for Beginners: High leverage can lead to significant losses for inexperienced traders. Beginners need to exercise caution and practice with smaller amounts or in Bybit’s testnet first.

Countries and Regulations

- Not Available in the U.S.: Due to regulatory restrictions, Bybit does not offer services to U.S. residents.

- Compliance: Bybit follows strict KYC/AML (Anti-Money Laundering) rules, although it remains mostly a crypto-to-crypto exchange.

Conclusion

Bybit is an excellent platform for advanced traders looking to trade crypto futures with high leverage and minimal latency. Its advanced risk management tools, robust infrastructure, and transparent fee structure make it a solid choice for professional traders. However, beginners should approach it with caution due to the complexity of leverage trading and the potential for significant losses.

Ideal For:

- Experienced futures traders.

- Traders who need high leverage.

- Users looking for fast and reliable trading execution.

If you’re new to crypto or prefer spot trading, you might want to consider exchanges like Binance or OKX, which offer more comprehensive services for beginners.