1. Choose a Reliable Exchange

- Popular exchanges: Major exchanges like Binance, Bitmart, Bybit, KuCoin, and OKX offer a wide range of coins and liquidity, meaning it’s easier to buy and sell without large price swings.

- Security features: Look for two-factor authentication (2FA), cold storage of assets (offline storage for security), and insurance against hacking incidents. Some exchanges also allow withdrawal whitelists, adding extra protection for your funds.

- Fees: Compare fees across exchanges. Spot trading fees are usually a percentage of your trade and may be lower if you hold the exchange’s native token (like Binance’s BNB). Watch out for deposit/withdrawal fees and maker/taker fees.

2. Create an Account

- Signing up: You’ll need to provide basic information like your email and phone number. Some exchanges allow you to trade small amounts without full verification, but larger transactions require Know Your Customer (KYC) verification.

- KYC verification: This involves uploading identification documents (e.g., passport or driver’s license) and sometimes a selfie for identity confirmation. Exchanges use this for compliance with regulations.

3. Deposit Funds

- Fiat deposits: Exchanges usually support deposits via bank transfers, debit/credit cards, and sometimes services like PayPal. Deposit fees may vary, so check this before choosing a method.

- Crypto deposits: If you already have crypto, you can send it directly to the exchange’s wallet. Make sure to use the correct blockchain (e.g., sending Ethereum-based tokens to an ERC-20 address).

- Stablecoins: Some traders use stablecoins like USDT (Tether) or USDC (USD Coin) as they are pegged to the U.S. dollar, minimizing volatility compared to crypto like Bitcoin.

4. Understand Market Orders

- Market Orders:

- Best for quick trades where you want to buy/sell immediately at the current price.

- However, in volatile markets, the price might differ slightly by the time the order is filled (slippage).

- Limit Orders:

- You set a specific price for buying or selling. Your order will only be filled when the market price reaches your set level.

- Useful for getting better prices or buying dips.

- Stop-Loss Orders:

- Automatically sells your crypto if the price drops below a certain point, helping you minimize losses.

- You can set both stop-loss and limit sell orders at the same time (this is known as a stop-limit order).

5. Analyze the Market

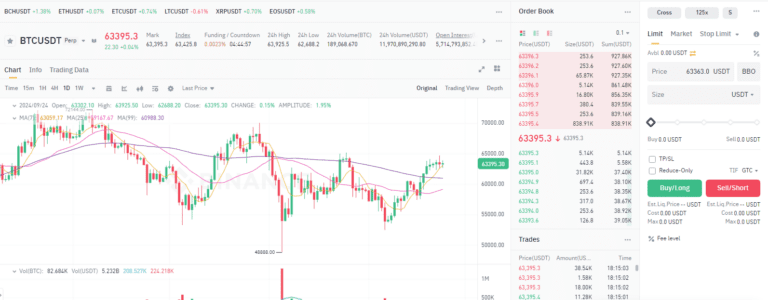

- Technical Analysis (TA):

- This method relies on historical price data, charts, and patterns to predict future movements.

- Key tools include:

- Candlestick charts: Provide detailed insight into the price action for a specific time frame.

- Moving Averages (MA): Help smooth out price data to identify trends. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA).

- RSI (Relative Strength Index): Shows if an asset is overbought or oversold (values above 70 = overbought, below 30 = oversold).

- MACD (Moving Average Convergence Divergence): Helps traders understand momentum and potential trend reversals.

- Fundamental Analysis (FA):

- Study the project’s fundamentals—team, technology, use cases, and community sentiment.

- Keep track of major events like partnerships, protocol upgrades, or regulatory announcements, as these can significantly impact price.

6. Place a Trade

- Selecting the trading pair: For example, if you want to buy Bitcoin with USD, choose the BTC/USD trading pair. If you’re trading between two cryptos, like Ethereum (ETH) and Bitcoin (BTC), you’d select the ETH/BTC pair.

- Placing a market order:

- Choose the amount of crypto to buy/sell, and the order will execute at the best available price.

- This is simple and quick but can lead to slippage (the difference between the expected price and the actual price).

- Placing a limit order:

- Choose the price at which you want to buy or sell. Your order will sit in the order book until someone is willing to meet your price.

- This is useful when you’re aiming for a specific price point, but it may take time for the trade to fill.

7. Monitor Your Trade

- Track positions: You can monitor your open trades on the exchange’s dashboard. Keep an eye on market fluctuations, as prices can change rapidly.

- Set stop-losses and take-profits:

- Stop-loss: Automatically sells your position if the price drops to a certain level to limit your losses.

- Take-profit: Automatically sells when the price reaches your desired profit target.

- These tools help manage risk and automate exits, which is important if you’re not actively monitoring the market.

8. Withdraw Profits

- Crypto withdrawals: Withdraw your funds to a secure wallet (hardware wallets like Ledger or Trezor are considered more secure than leaving funds on an exchange). Be sure to double-check the withdrawal address before confirming.

- Fiat withdrawals: If you want to cash out, you can sell your crypto for fiat and withdraw to your bank account. This may take a few days depending on your bank and the exchange.

Bonus Tips:

- Stay Updated:

- Crypto prices are highly sensitive to market sentiment, regulations, network upgrades, and macroeconomic factors.

- Following news sources like CoinTelegraph, CoinDesk, or social media platforms like Twitter (X) and Reddit can help you stay on top of relevant information.

- Diversify:

- Diversifying your portfolio across different cryptocurrencies can reduce risk, especially since individual assets can be highly volatile.

- Risk Management:

- Crypto is volatile. A common strategy is to only invest what you can afford to lose. Set clear goals for your trades, and use stop-loss and take-profit strategies.

Spot trading is relatively straightforward once you understand the mechanics and tools at your disposal. Do you want to explore any specific strategy for spot trading, or learn more about risk management in detail?